All about Paul B Insurance Insurance Agent For Medicare Melville

50 each each month in 2019., the Medicare Advantage program, is not independently funded; Medicare Advantage prepares provide advantages covered under Component A, Part B, and (typically)Component D, and also these benefits are funded primarily by payroll taxes, general incomes, and also costs. Medicare Benefit

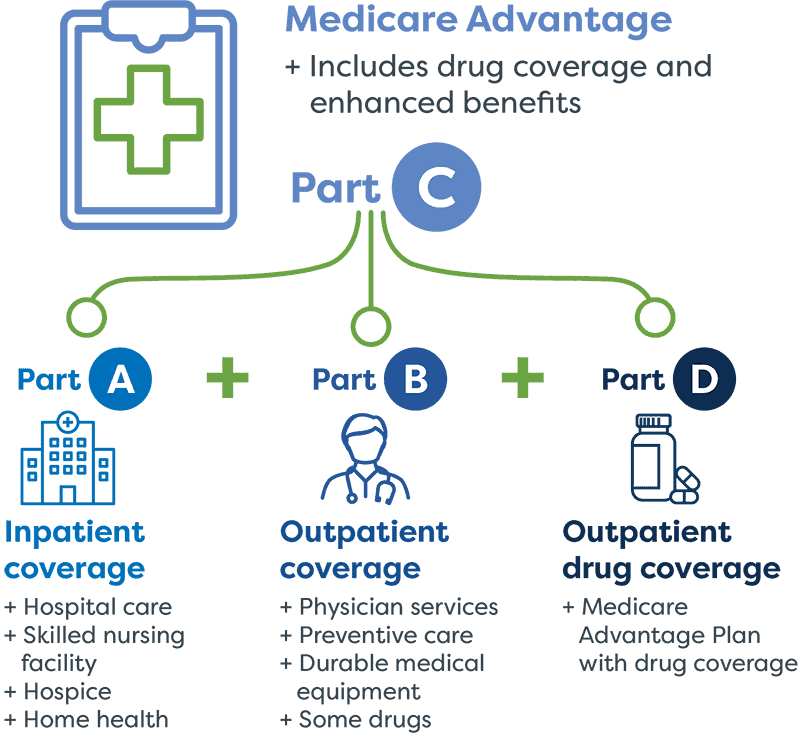

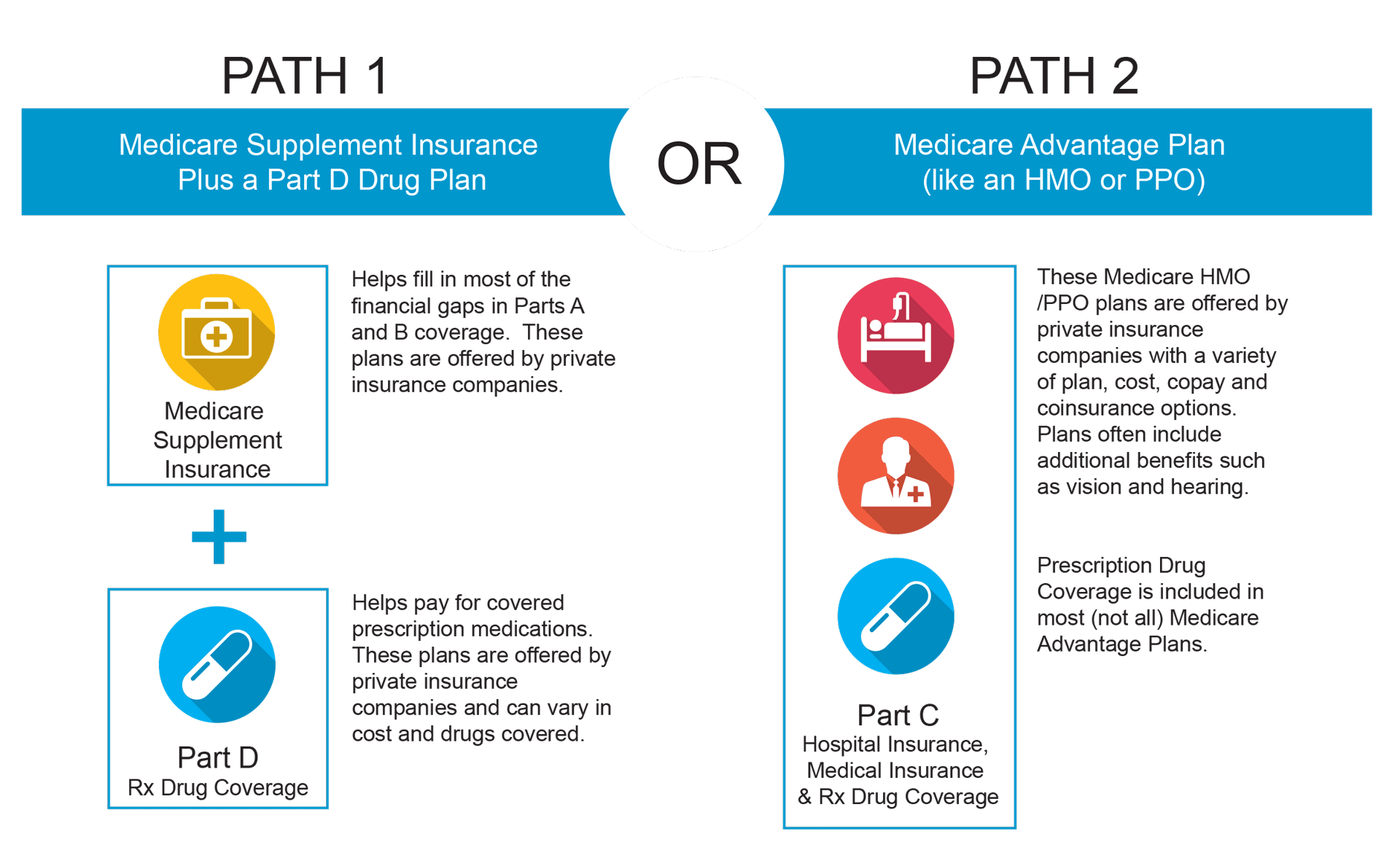

enrollees generally pay the regular monthly Part B costs and also many also pay an additional premium directly to their strategy. is funded by basic revenues, recipient costs, and also state settlements. The typical PDP premium for 2018 was$ 41 per month. Part D enrollees with higher revenues pay an income-related premium surcharge, with the very same income thresholds used for Part B. paul b insurance Medicare Part D melville. In 2019, costs surchargesvary from$ 12. 40 to$77. Policymakers, health care providers, insurance companies, and also researchers remain to discuss how best to present payment as well as delivery system reforms into the healthcare system to tackle rising costs, top quality of care, and also inefficient investing. Medicare has actually taken a lead in checking a selection of brand-new models that include economic rewards for providers, such as physicians and healthcare facilities, to interact to reduced costs and enhance treatment forpatients in standard Medicare. Accountable Care Organizations(ACOs)are one example of a delivery system reform design presently being checked within Medicare. With over 10 million designated recipients in 2018, ACO models permit groups of providers to accept obligation for the overall care of Medicare beneficiaries and share in monetary savings or losses relying on their performance in meeting investing as well as care top quality targets. Much of these Medicare payment versions are handled with the Center for Medicare as well as Medicaid Development(CMMI), which was created by the Affordable Treatment Act (ACA). These versions are being assessed to identify their impact on Medicare investing as well as the top quality of treatment provided to recipients. The Secretary of Health and Human Being Provider (HHS )is accredited to broaden or prolong versions that demonstratetop quality renovation without a boost in costs, or investing decrease without a decline in quality. While Medicare investing is on a slower higher trajectory now than in past decades, overall and per capita annual development prices appear to be edging far from their traditionally low degrees of the past few years. Medicare prescription drug investing is also a growing worry, with the Medicare Trustees predicting a somewhat greater per capita growth price for Part D in the coming years than in the program's earlier years as a result of greater prices connected with expensive specialized drugs. As policymakers take into consideration feasible changes to Medicare, it will certainly be essential to review the possible result of these modifications on total healthcare spending as well as Medicare costs, along with on beneficiaries'accessibility to high quality care and economical protection as well as their out-of-pocket healthcare costs. A Medicare Advantage is an additional method to obtain your Medicare Part An and Component B protection. Medicare Advantage Plans, in some cases called"Component C"or"MA Plans,"are used by Medicare-approved private companies that should adhere to rules established by Medicare. If you join a Medicare Advantage Strategy, you'll still have Medicare however you'll obtain a lot of your Component An and also Part B insurance coverage from your Medicare Advantage Plan, not Initial Medicare. With a you can try this out Medicare Advantage Strategy, you may have coverage for things Original Medicare does not cover, like fitness programs(health club subscriptions or price cuts)and some vision, hearing, as well as oral solutions(like regular check ups or cleanings).

Fascination About Paul B Insurance Medicare Advantage Plans Melville

Strategies can additionally choose to cover much more advantages. As an example, some strategies might use protection for services like transport to doctor check outs, over-the-counter drugs, and also solutions that promote your wellness and health. These bundles will certainly provide benefits personalized to treat particular problems. Consult the plan prior to you.

enlist to see what benefits it supplies, if you may qualify, as well as if there are any constraints. Discover more about what Medicare Benefit Plans cover. Medicare pays a set amount for your treatment monthly to the companies supplying Medicare Benefit Plans. Each Medicare Benefit Strategy can charge various out-of-pocket prices. They can likewise have different policies for just how you get solutions, like: Whether you need a referral to see an expert If you have to go to doctors, facilities, or vendors that belong to the prepare for non-emergency or non-urgent treatment These regulations can alter every year. In the majority of cases, you'll require to make use of health and wellness care carriers who take part in the plan's network. Some strategies will not cover services from service providers outside the strategy's network and service area. Medicare Advantage Strategies have a on your out-of-pocket prices for all Component An and also Part B services. When you reach this restriction, you'll

pay absolutely nothing for solutions Part An as well as Component B cover. You can sign up with a different Medicare drug plan with certain sorts of strategies that: Can't provide medication protection (like Medicare Medical Interest-bearing account strategies )Choose not to use drug insurance coverage(like some Personal Fee-for-Service plans)You'll be disenrolled from your Medicare Advantage Strategy and also returned to Original Medicare if both of these use: You're in a Medicare Advantage HMO or PPO. If you join an HMO or PPO that doesn't cover drugs, you can't sign up with a separate Medicare medication plan. In this situation, either you'll need to use other prescription medication protection you have(like company or retiree insurance coverage ), or do without medication insurance coverage. If you decide not to get Medicare medicine coverage when you're initial eligible and also your various other medicine insurance coverage isn't creditable prescription drug coverage, you may have to pay a late enrollment fine if you sign up with a strategy later. You can not make use of Medigap to pay for any kind of prices( copayments, deductibles, and also costs )you have under a Medicare Benefit Strategy. Learn more about your options connected to Medigap policies as well as Medicare Advantage Program. The standard details in this pamphlet offers an overview of the Medicare program. Much more comprehensive information on Medicare's benefits, prices, and wellness service choices is readily available from the Centers for Medicare & Medicaid Services (CMS) magazine which is mailed to Medicare beneficiary households each loss as well as to new Medicare beneficiaries when they come to be eligible for coverage. It provides standard security against the cost of healthcare, yet it doesn't

Comments on “The 8-Second Trick For Paul B Insurance Local Medicare Agent Melville”